Do You Toss Your Paystub Every Week? Maybe It’s Time To Take a Closer Look

What you do with your paystub often depends on how you get paid. If you have direct deposit there’s a good chance that you just rip the entire thing up without a glance, confident in the fact that the money is in your bank account...

TAX ISSUES WHEN CONVERTING A HOME INTO A RENTAL

Article Highlights: Reason for Conversion Basis Depreciation Cash Flow versus Tax Profit or Loss Passive Losses Home Gain Exclusion Other Tax Issues Becoming a Landlord With the current substantial appreciation in home values and demand for housing exceeding the available inventory, along with low home mortgage interest rates, more and more homeowners are converting...

Small Business: Rent Expenses May Be Tax-deductible

If you're a small business owner who is just starting out, you may not realize that some rent expenses may be deductible on your tax return. Here are some things small business owners should keep in mind when it comes to deducting rental expenses: How Rent...

Cash Management Tips for Your Small Business

Cash flow is the lifeblood of every small business but many business owners underestimate just how vital managing cash flow is to their business's success. In fact, a healthy cash flow is more important than your business's ability to deliver its goods and services. While that...

FOREIGN INCOME AND TAX REPORTING ISSUES

Article Highlights: Non-Resident Alien Spouse Foreign Rentals Foreign Pensions Foreign Income Exclusion FBAR Statement of Specified Foreign Financial Assets Credit of Foreign Tax Paid Canadian Registered Retirement Savings & Income Plans Reporting Receipt of Foreign Gifts or Bequests Reporting Ownership or Transactions with Foreign Trusts Annual Information Return for Foreign Trust with U.S. Owner Ownership or Voting...

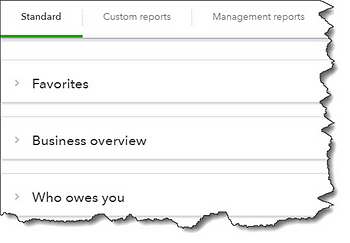

You should be running reports in QuickBooks Online

You should be running reports in QuickBooks Online on a weekly—if not daily—basis. Here’s what you need to know. You can do a lot of your accounting work in QuickBooks Online by generating reports. You can maintain your customer and vendor profiles. Create and send transactions...

THE TAX-FILING DEADLINE IS DRAWING NEAR

Article Highlights: Extensions Balance-Due Payments Contributions to Roth or Traditional IRAs Individual Refund Claims for the 2018 Tax Year Missing Information As a reminder to those who have not yet filed their 2021 tax returns, April 18, is the due date to either file a return (and pay the taxes owed)...

YOU MAY QUALIFY FOR THE 20% TAX PASS-THROUGH DEDUCTION

Article Highlights: Sec 199A Deduction Qualified Business Income Threshold Specified Service Businesses Limitations Wage Limitation Aggregating Amounts Several years ago, when Congress changed the tax-rate structure for C corporations to a flat rate of 21% instead of the former graduated rates that topped out at 35%, they also came up with a new...

Inheritances Enjoy a Special Tax Benefit

Article Highlights: · Stepped-Up Basis · Inherited Basis · Inheritance Basis Example · Step Down Basis · Long-Term Capital Gains Tax Rates · Jointly Owned Property · Gifting Prior to Death You may hear people use the term “Stepped-Up Basis” that many believe is a tax provision that allows beneficiaries of an inheritance...

Read This Before Tapping Your Retirement Savings

Article Highlights: · Tapping Your Retirement Savings · Traditional IRAs and Qualified Retirement Plans · Simple IRAs · Early-Withdrawal Penalties · Reduction in Retirement Savings · Exceptions from the Early-Withdrawal Penalty · Roth IRAs Your 401(k), IRA or other retirement accounts may be a tempting source for cash if you find yourself short...