Mandatory – Business Beneficial Ownership Reporting for 2024

Beneficial Ownership Information

In the Ever-Evolving Landscape of Business Regulations: Understanding the Corporate Transparency Act (CTA)

In the dynamic world of business regulations, the Corporate Transparency Act (CTA), a component of the National Defense Authorization Act for Fiscal Year 2021, introduces crucial reporting requirements for businesses in the United States, focusing primarily on beneficial ownership. Though this reporting isn’t mandated until 2024, it’s imperative for businesses to stay informed and prepare in advance.

The CTA’s main goal is to combat illicit activities such as money laundering, tax fraud, and terrorism financing. It achieves this by increasing transparency in the ownership structures of companies. The Act requires corporations, limited liability companies (LLCs), and similar entities to report their beneficial owners to the Financial Crimes Enforcement Network (FinCEN).

What Is FinCEN?

The Financial Crimes Enforcement Network (FinCEN) is a bureau of the U.S. Department of the Treasury, established in 1990. Its primary role is to protect the financial system from illicit use, combat money laundering, and promote national security through financial intelligence.

FinCEN collaborates with law enforcement, intelligence agencies, financial institutions, and regulatory bodies. It enforces parts of the Bank Secrecy Act, including the mandate for financial institutions to report activities suggestive of money laundering, tax evasion, or other financial crimes.

Companies Required to Report Beneficial Ownership Information to FinCEN

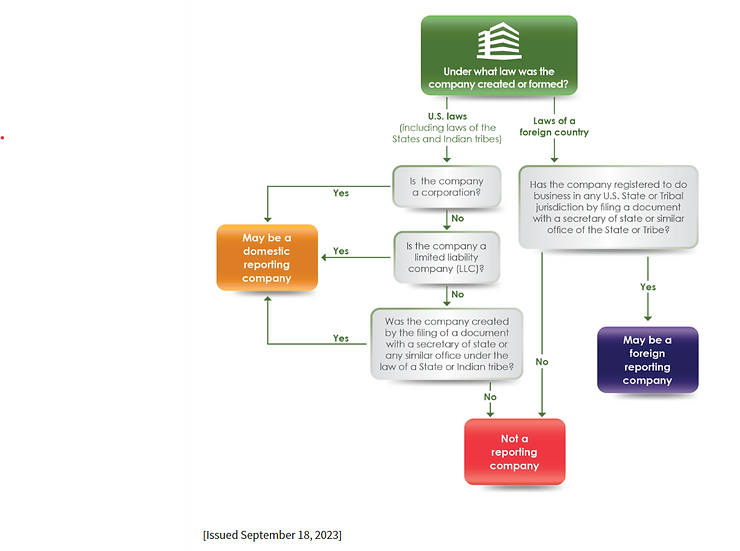

There are two categories of reporting companies:

- Domestic Reporting Companies: This includes corporations, LLCs, and other entities created by filing documents with a secretary of state or similar office in the United States.

- Foreign Reporting Companies: These are entities formed under foreign law that have registered to do business in the U.S.

It’s important to note that 23 types of entities are exempt from these reporting requirements. Businesses should review FinCEN’s Q&A C.2 to understand if they qualify for exemption.

Mandatory – Business Beneficial Ownership Reporting for 2024

FAQs

Who is a Beneficial Owner?

Under the CTA, a beneficial owner is defined as an individual who either exercises substantial control over a company or owns at least 25% of its ownership interests. There can be multiple beneficial owners for a single company, and certain entities like publicly traded companies and banks are excluded from this requirement.

Filing Due Dates

- Existing Businesses: Must file their initial BOI report by January 1, 2025, if they existed as of January 1, 2024.

- New Businesses: Have different filing deadlines based on their formation date.

Penalties

Non-compliance can lead to significant fines and potential imprisonment. A willful failure to report accurate information may result in civil penalties up to $500 per day, or criminal penalties including imprisonment or fines up to $10,000.

Updates

Businesses must update or correct reported information to FinCEN as changes occur or inaccuracies are discovered.

FinCEN Small Entity Compliance Guide

This guide provides interactive tools and aids to help businesses understand and comply with the BOI reporting requirements.

How Does a Company File a BOI Report?

BOI reports must be filed electronically through FinCEN’s online secure filing system, which will be available starting January 1, 2024.

Navigating the CTA’s Complexities

Understanding and complying with the CTA’s reporting requirements can be challenging. Businesses are encouraged to seek assistance to navigate this new regulatory landscape effectively.

Extended Article on the Corporate Transparency Act (CTA): A Broad Perspective for Small Businesses

FinCEN’s Role: A Broader Understanding

The Financial Crimes Enforcement Network (FinCEN), an agency within the U.S. Department of the Treasury, is at the forefront of enforcing the CTA. Its role extends beyond specific sectors, affecting all small businesses in the U.S., from retail to tech startups. FinCEN’s mission to protect the financial system aligns with the CTA’s goals of promoting transparency and security in business operations.

Implications for All Small Businesses

The CTA’s requirement to disclose beneficial ownership information is not limited to corporations but encompasses a wide range of small businesses. Whether you operate a boutique, a tech firm, or a consultancy, understanding your reporting obligations under the CTA is crucial. The Act encourages all small businesses to maintain accurate records of their ownership structures.

Who is a Beneficial Owner?

The CTA defines a beneficial owner as someone with significant control or ownership in a company. This definition applies universally, from a local cafe owner to a tech entrepreneur. Accurately identifying and reporting beneficial owners is a shared responsibility among all small business owners.

Compliance and Reporting for All

The initial BOI reporting deadline is January 1, 2025, for existing businesses as of January 1, 2024. New businesses formed after this date have different deadlines. It’s important for all small businesses to be aware of these timelines to ensure compliance and avoid potential penalties.

The Value of Accurate Record-Keeping

The CTA highlights the importance of meticulous record-keeping for all businesses. This isn’t just a requirement – it’s a best practice that enhances the credibility and stability of your business, be it a local store or a professional service provider.

Preparing for Compliance Across Industries

All small businesses should begin preparations for compliance by reviewing their ownership structures. This preparation is not industry-specific but a universal step towards greater business integrity and transparency.

Technology as a Compliance Aid

The digital era offers tools that can assist businesses in managing their reporting requirements. This is relevant for all sectors, not just tech-oriented businesses. Utilizing digital solutions can streamline the process, ensuring accuracy and efficiency in compliance.

Leveraging Technology for Accurate Accounting and Efficient Small Business Bookkeeping

In the context of the CTA’s impact on small businesses, the role of technology in facilitating accurate accounting and efficient small business bookkeeping becomes increasingly significant. Modern solutions like online bookkeeping services are not just about convenience; they are critical tools for maintaining compliance with regulations such as the CTA. These digital platforms ensure precision in record-keeping, a cornerstone of accurate accounting, which is vital for adhering to the reporting requirements of the new law.

For those at the beginning of their financial management journey, QuickBooks training for beginners offers an essential foundation. This training simplifies the complexities of financial software, enabling small business owners to confidently handle their bookkeeping needs. By adopting these advanced bookkeeping solutions and educational resources, small businesses can navigate the challenges of the CTA with greater ease, ensuring their financial practices are both transparent and in line with current regulations.

Addressing Privacy Concerns

The CTA raises valid privacy considerations for all business owners. It’s vital to understand how sensitive information reported to FinCEN is protected and used. This awareness is crucial for maintaining client trust and upholding privacy standards.

Final Reflections for Small Businesses

The introduction of the CTA is a significant milestone for the U.S. corporate landscape, affecting businesses in every sector. Mandatory business beneficial ownership reporting can be an opportunity for all small business owners to reinforce their commitment to transparency and ethical practices. Staying informed, preparing for compliance, and using technology effectively are key steps towards navigating this new regulatory environment.

This article is meant for educational purposes only. Articles contain general information about accounting and tax matters and is not tax advice and should not be treated as such. Do not rely on this information as an alternative to seeking assistance from a certified accountant/tax professional. Perlinger Consulting partners with certified tax professionals to assist our clients.