DON’T BE A VICTIM – HUGE INCREASE IN SCAM TEXTS

Article Highlights: ID Thieves Are Constantly After Your ID Information There Has Been an Exponential Increase in Text Scams Your Phone Is Their Target How to Report Text and Phishing Scams to the Government. Taxpayers should be aware of the recent increase in IRS-themed texting scams aimed at stealing personal...

Your Retirement Contribution Limits Announced for 2023

Cost of living adjustments affecting dollar limitations for pension plans and other retirement-related items for 2023 are as follows: 401(k), 403(b), 457 plans, and Thrift Savings Plan Contribution limits for employees who participate in 401(k), 403(b), most 457 plans, and the federal government's Thrift Savings Plan increases...

TAX CONSEQUENCES OF EMPLOYEE HOLIDAY GIFTS

Article Highlights: De Minimis Fringe Benefits Cash Gifts Gift Certificates Group Meals FICA and Wage Withholding It is common practice this time of year for employers to give their employees gifts. Where a gift is infrequently offered and has a fair market value so low that it is impractical and unreasonable...

TAKE FINAL ACTION TO AFFECT YOUR 2022 TAXES

December 1 - Time for Year-End Tax Planning December is the month to take final actions that can affect your tax result for 2022. Taxpayers with substantial increases or decreases in income, changes in marital status or dependent status, and those who sold property during 2022...

YOUR YEAR-END GIFT GIVING – GET TAX BENEFITS

Article Highlights: Watch Out for Holiday Gift Scams Gifts with Tax Benefits Gift of College Tuition Qualified Tuition Programs Qualified Charitable Distribution Donor-Advised Funds Work Equipment Employee Gifts Monetary Gifts to Individuals Documentation Timing The holiday season is customarily a time of giving gifts, whether to your favorite charity, family members or others. Some gifts even provide...

THE IRS ACHIEVES A 90% CONVICTION RATE

There's an old saying that reminds us that there are only two certainties in this life: "death, and taxes." Whoever coined that phrase couldn't have known how true it was, particularly when it comes to the latter portion. The Internal Revenue Service recently came out with...

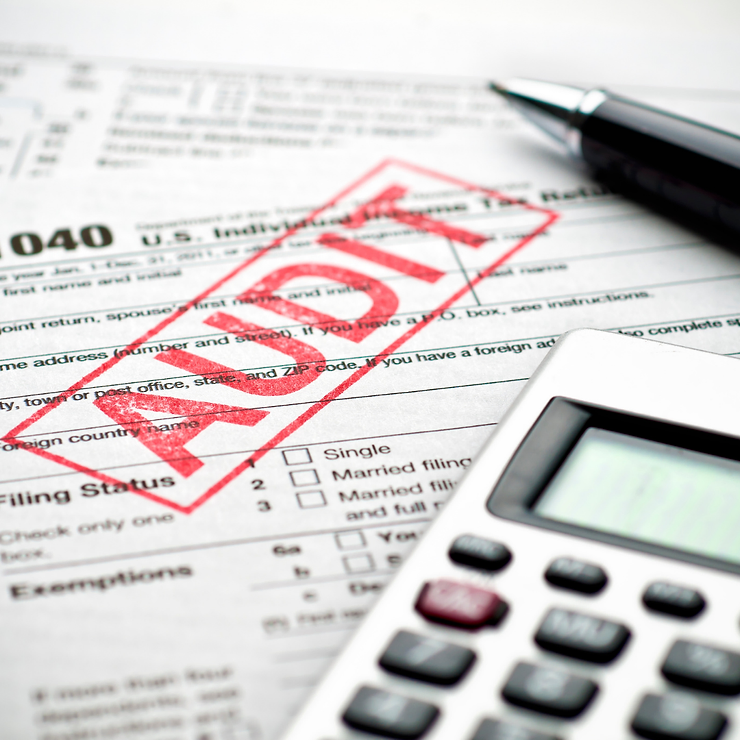

Tips for Avoiding an IRS Tax Audit

Although the chances of taxpayers being audited have declined in recent years, with taxes becoming more complicated every year, there is always the possibility that a tax mistake turns into an IRS tax audit. Avoiding "red flags" like the ones listed below could help. Claiming Business...

STEPS FOR YOUR SMALL BUSINESS TO SURVIVE A RECESSION

According to one recent study, there is a 96% chance that the United States will experience some form of economic recession within the next 12 months. If you needed a single statistic to underline the importance of planning ahead when it comes to your business,...

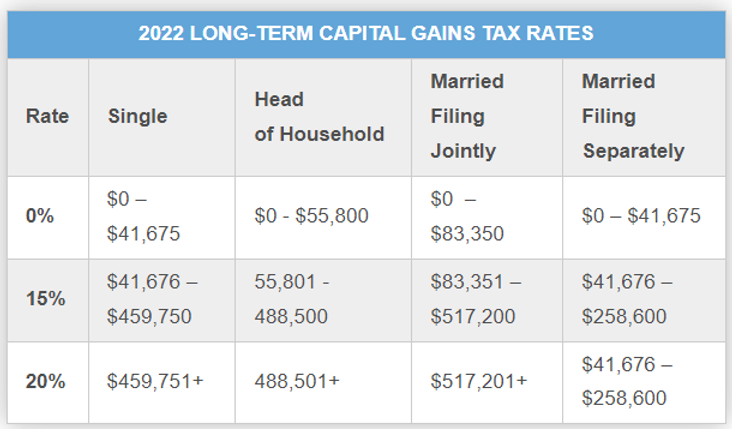

MANAGING YOUR GAINS AND LOSSES IN A TURBULENT YEAR

Article Highlights: Rough Year for the Stock Market Year End Approaching Annual Capital Losses Are Limited Be Aware of Wash Sale Rules Off-Set Short-Term Gains with Long-Term Capital Losses Planning for Zero Tax on Long-Term Capital Gains Converting a Traditional IRA to a Roth It's been a rough Fall for the stock market....

IRS TO TARGET ABUSIVE ERTC CLAIMS

Article Highlights: Television Promotions Payroll Tax Credit Applicable Years Qualifications Business Operations Curtailed Significant Decline in Gross Receipts Potential Abuse Have you seen those ads on television or received email solicitations promoting a large tax credit? The large tax credit they are referring to is the employee retention tax credit (ERTC). The ERTC...